Best CRM For Financial Services: Enhancing Customer Relationships And Compliance

Best CRM for Financial Services opens the door to a world of tailored solutions and enhanced customer experiences in the finance sector. From addressing compliance requirements to streamlining processes, this topic delves into the key features and benefits of CRM systems for financial institutions.

Introduction to CRM for Financial Services

In the realm of financial services, Customer Relationship Management (CRM) refers to the strategies, technologies, and practices that companies use to manage and analyze customer interactions and data throughout the customer lifecycle. CRM systems are crucial tools for financial institutions to enhance customer relationships, improve customer retention, and drive business growth.

Importance of CRM for Financial Institutions

CRM plays a vital role in the financial sector by providing a centralized platform for managing customer information, interactions, and transactions. By leveraging CRM systems, financial institutions can personalize customer experiences, streamline communication, and gain valuable insights into customer behavior and preferences.

Key Features of CRM Systems for Financial Services Companies

- Centralized Customer Database: CRM systems consolidate customer data from various channels, allowing financial institutions to access a 360-degree view of each customer.

- Lead Management: CRM systems help financial companies track and manage leads effectively, ensuring timely follow-ups and personalized communication.

- Automation Capabilities: CRM platforms automate repetitive tasks, such as email campaigns and customer notifications, improving operational efficiency.

- Analytics and Reporting: CRM systems provide advanced analytics tools to generate reports on customer trends, sales performance, and campaign effectiveness.

- Integration with Other Tools: CRM systems can integrate with other software solutions, such as accounting systems and marketing platforms, to create a seamless workflow.

Specific Needs of Financial Services Industry

In the financial services industry, there are specific challenges that require tailored CRM solutions to effectively manage customer relationships and ensure compliance with regulations.

Addressing Compliance and Regulatory Requirements

CRM systems play a crucial role in helping financial institutions comply with strict regulatory requirements. By centralizing customer data and interactions, CRM platforms can ensure that all communications and transactions meet legal standards. Automated compliance checks and documentation features also help in monitoring and reporting regulatory activities efficiently.

Importance of Data Security and Privacy

Data security and privacy are paramount in the financial services sector. CRM systems must adhere to stringent security measures to protect sensitive customer information. Encryption, access controls, and regular security audits are essential components of a secure CRM solution for financial institutions.

Role of AI and Automation

AI and automation have revolutionized customer relationship management in the financial industry. These technologies enable personalized customer interactions, predictive analytics for better decision-making, and streamlined processes. Chatbots, predictive modeling, and automated workflows enhance efficiency and customer satisfaction in financial CRM systems.

Successful CRM Implementation in Financial Sector

Several financial institutions have successfully implemented CRM systems to improve customer satisfaction and retention. For example, a major bank utilized CRM to analyze customer preferences and tailor product recommendations, leading to a significant increase in customer loyalty. Another investment firm implemented CRM to track client interactions and provide timely investment advice, resulting in improved client retention rates.

Key Features to Look for in CRM for Financial Services

When selecting a CRM system for financial services, it is crucial to consider key features that cater specifically to the needs of the industry. These features are essential for effectively managing client relationships, improving operational efficiency, and enhancing overall business performance.

Lead Management

Lead management is a critical feature that allows financial service providers to track and nurture potential clients throughout the sales cycle. A robust CRM system should offer tools for capturing, organizing, and prioritizing leads, as well as automating follow-up processes to convert leads into customers effectively.

Customer Segmentation

Customer segmentation capabilities enable financial institutions to categorize clients based on various criteria such as demographics, behavior, and preferences. This feature allows for targeted marketing campaigns, personalized communication, and tailored product offerings, ultimately enhancing customer satisfaction and retention.

Reporting

Comprehensive reporting features are essential for monitoring key performance metrics, analyzing sales data, and gaining valuable insights into business operations. Financial service providers can leverage CRM reporting tools to track revenue, assess campaign effectiveness, and identify opportunities for growth and improvement.

Integration with Financial Tools

Integration with financial tools such as accounting software and payment processors is crucial for seamless data flow and operational efficiency. A CRM system that integrates with existing financial tools enables streamlined processes, eliminates manual data entry errors, and ensures accurate financial reporting.

Automation

Automation plays a vital role in streamlining processes for financial service providers by reducing manual tasks, improving workflow efficiency, and enhancing productivity. Automated workflows, email communications, and task assignments help save time and resources while maintaining consistency and accuracy in client interactions.

Compliance and Regulatory Considerations

In the financial services industry, compliance and regulatory considerations play a crucial role in ensuring the security and confidentiality of sensitive information. CRM systems can assist in maintaining compliance with industry-specific regulations and standards, such as those set forth by regulatory bodies like HIPAA, FDA, and telecommunications sector authorities.

Role of CRM in Ensuring Adherence to HIPAA Regulations

CRM systems play a vital role in ensuring adherence to HIPAA regulations by providing a secure platform for storing and managing patient data. They offer features such as access controls, encryption, and audit trails to protect sensitive information from unauthorized access or breaches.

Specific Features of CRM Systems for Maintaining Compliance with FDA Regulations

CRM systems designed for pharmaceutical companies include specific features to aid in maintaining compliance with FDA regulations. These features may include batch tracking, quality control management, and reporting functionalities to ensure adherence to regulatory requirements throughout the product lifecycle.

Customization of CRM for Industry-Specific Regulations

CRM systems can be customized to meet the requirements of industry-specific regulations, such as those in the telecommunications sector. By incorporating industry-specific compliance modules and workflows, CRM platforms can help organizations align their processes with regulatory standards and ensure seamless compliance with relevant regulations.

Conducting Regular Compliance Audits Using CRM Data

CRM systems enable organizations to conduct regular compliance audits by providing real-time access to data and analytics. By analyzing CRM data, organizations can identify potential compliance issues, track adherence to regulatory requirements, and implement corrective actions to mitigate risks effectively. This data-driven approach to compliance auditing contributes to overall risk management strategies and helps organizations proactively address compliance challenges before they escalate.

Customer Relationship Management in Wealth Management

Customer Relationship Management (CRM) systems play a crucial role in enhancing client communication and relationship building in the wealth management industry. These tools help financial advisors better understand client needs and preferences, ultimately leading to more personalized interactions and tailored services.

Role of Personalized Interactions and Tailored Services

Personalized interactions and tailored services are essential in CRM for wealth management firms as they allow advisors to cater to the unique needs of each client. By utilizing CRM systems, financial professionals can track client preferences, investment goals, and risk tolerance to provide customized recommendations and solutions.

Examples of CRM Benefits for Financial Advisors

CRM systems enable financial advisors to access client information quickly, schedule follow-up appointments, and send personalized communications. For instance, advisors can set reminders to review clients’ portfolios regularly or send birthday greetings to strengthen client relationships.

Data Security and Privacy Measures

Implementing CRM systems in wealth management requires robust data security and privacy measures to safeguard sensitive client information. Encryption, access controls, and regular security audits are essential to ensure that client data is protected from cyber threats.

Automation Features for Streamlining Administrative Tasks

Automation features in CRM systems can streamline administrative tasks for wealth management professionals, allowing them to focus more on client relationships and strategic decision-making. Tasks such as data entry, document management, and reporting can be automated, saving time and improving efficiency.

Enhancing Customer Experience with CRM

In today’s competitive financial services industry, enhancing customer experience is crucial for retaining clients and attracting new ones. Customer Relationship Management (CRM) systems play a vital role in achieving this goal by helping financial institutions streamline processes and personalize interactions with clients.

Improving Customer Onboarding Processes

CRM systems can significantly improve customer onboarding processes in financial services by centralizing customer data, automating workflows, and ensuring compliance with regulatory requirements. By having a unified view of each client, financial institutions can reduce manual errors, speed up the onboarding process, and provide a seamless experience for new customers.

Creating a Seamless Omni-Channel Experience

CRM enables financial institutions to create a seamless omni-channel experience for banking and insurance customers by integrating multiple communication channels such as email, phone, chat, and social media. This integration allows customers to interact with the institution through their preferred channels, leading to a consistent and personalized experience across all touchpoints.

Delivering Personalized Services

CRM systems help financial institutions deliver personalized services to clients by analyzing customer data, preferences, and behavior. By leveraging this information, institutions can tailor their offerings, recommend relevant products or services, and anticipate customer needs. This personalized approach not only enhances the customer experience but also fosters long-term relationships with clients.

Key Features for Effective Customer Relationship Management

– Centralized customer database for easy access to client information

– Automated workflows for efficient processes

– Integration with communication channels for seamless interactions

– Analytics and reporting tools for data-driven insights

– Customizable dashboards for personalized user experience

Implementation in Traditional vs. Digital-Only Banks

While traditional banks may face challenges in integrating CRM systems due to legacy systems and processes, digital-only banks have the advantage of starting with a clean slate, making implementation smoother and more agile. However, both types of institutions can benefit from CRM in enhancing customer experience and driving business growth.

Ethical Considerations in CRM Usage

Financial institutions must consider ethical implications when using CRM to enhance customer experience. This includes ensuring data privacy and security, obtaining customer consent for data usage, and maintaining transparency in how customer data is collected and utilized. By upholding ethical standards, institutions can build trust with clients and demonstrate their commitment to responsible data management.

Integration with Financial Tools and Software

CRM integration with financial tools and software is crucial for enhancing operational efficiency and providing a seamless experience for financial services professionals. By connecting CRM systems with accounting software, banking software, and financial planning tools, firms can optimize their processes and improve client interactions.

Accounting Software Integration for Financial Reporting

- CRM integration with accounting software allows for real-time updates on financial data, enabling accurate and timely reporting.

- By syncing CRM with accounting systems, financial services firms can track client transactions, monitor revenue streams, and generate comprehensive financial reports with ease.

- Automation of data transfer between CRM and accounting software minimizes errors and ensures data consistency across platforms.

Streamlining Loan Origination and Processing through Banking Software Integration

- CRM integration with banking software facilitates a smooth flow of information between loan officers and clients, expediting the loan origination and approval process.

- Automated data entry and document management within CRM systems reduce manual tasks and enhance collaboration between banking and financial teams.

- By linking CRM with banking software, financial institutions can provide personalized loan solutions based on client profiles and financial histories.

CRM Integrations with Financial Planning Tools for Wealth Management Firms

- Integrating CRM with financial planning tools enables wealth management firms to create customized investment strategies and financial plans for clients.

- By combining client data from CRM with financial planning software, advisors can offer tailored recommendations and track the performance of client portfolios effectively.

- Automation of financial planning processes through CRM integration improves decision-making and enhances the overall client experience in wealth management.

Data Analytics and Reporting Capabilities

CRM systems in the financial services industry play a crucial role in helping institutions analyze customer data to make informed decisions. By utilizing data analytics and reporting capabilities, financial companies can gain valuable insights into customer behavior and preferences.

Predictive Analytics in CRM

Predictive analytics within CRM systems for financial services enable companies to forecast customer behavior based on historical data and patterns. By using advanced algorithms and statistical models, financial institutions can anticipate trends, identify potential risks, and tailor their strategies to meet customer needs effectively.

Real-time Reporting and Dashboards

Real-time reporting and dashboards are essential features in CRM systems for financial services companies. These tools provide up-to-date information on key performance indicators (KPIs), customer interactions, and sales activities. By having access to real-time data, financial professionals can make timely decisions and respond quickly to market changes.

Key Performance Indicators (KPIs)

Key performance indicators that can be tracked using CRM data in financial institutions include customer acquisition costs, customer lifetime value, sales conversion rates, and customer satisfaction scores. These KPIs help organizations measure their performance, identify areas for improvement, and optimize their customer relationships.

Customized Reports in CRM

Creating customized reports in CRM systems tailored to the specific needs of financial services companies involves selecting relevant data points, defining metrics, and designing visualizations. Financial professionals can generate reports on customer segmentation, marketing campaigns, sales pipelines, and revenue forecasts to gain actionable insights and drive business growth.

Data Visualization Tools

Data visualization tools enhance the presentation of CRM analytics by transforming complex data sets into interactive charts, graphs, and dashboards. These tools help financial professionals visualize trends, patterns, and relationships in the data, making it easier to interpret and communicate insights effectively.

Customization and Scalability of CRM Solutions

Customizable CRM solutions play a crucial role in meeting the unique needs of financial institutions. These institutions have specific requirements and workflows that may not be adequately addressed by off-the-shelf CRM systems. By customizing the CRM solution, financial services firms can tailor the platform to align with their business processes, compliance requirements, and customer interactions.

Importance of Customization in CRM for Financial Services

Customization allows financial institutions to adapt the CRM system to their specific business needs. For example, they can customize data fields to capture relevant information about clients, personalize communication templates to reflect the brand voice, and create custom reports to analyze performance metrics. This level of flexibility ensures that the CRM solution enhances operational efficiency and improves customer service.

- Customizing data fields to capture client-specific information, such as investment preferences, risk tolerance, and financial goals.

- Personalizing communication templates for client outreach, marketing campaigns, and follow-up activities.

- Creating custom dashboards and reports to track key performance indicators, monitor sales activities, and analyze customer interactions.

Scalability Considerations for CRM Systems

When selecting a CRM system for a growing financial services firm, scalability is a critical factor to consider. The CRM solution should be able to accommodate the increasing volume of data, users, and transactions as the business expands. Scalability ensures that the CRM system can grow with the organization without compromising performance or functionality.

- Ability to handle large datasets without experiencing lags or performance issues.

- Scalable user access levels to accommodate new team members and roles within the organization.

- Integration capabilities with other systems and applications to support business expansion and evolving needs.

Improving Operational Efficiency with CRM Customization

Customizing the CRM solution can significantly enhance operational efficiency in financial services. By streamlining workflows, automating repetitive tasks, and centralizing client information, financial institutions can reduce manual errors, improve data accuracy, and increase productivity. CRM customization empowers organizations to deliver personalized services, make data-driven decisions, and build stronger relationships with clients.

- Automating lead assignment and follow-up processes to ensure timely responses and efficient lead management.

- Integrating CRM with other tools and software used in financial services, such as portfolio management systems and compliance platforms.

- Implementing workflows and approval processes to standardize operations, ensure regulatory compliance, and enhance collaboration among team members.

Training and Support for CRM Implementation

Implementing a CRM system in the financial services industry requires comprehensive training and ongoing support to ensure its successful integration and utilization. Training programs play a crucial role in preparing employees for the new system, while ongoing support and maintenance are essential for maximizing the benefits of CRM for financial institutions.

Importance of Training Programs

- Training programs help employees understand the features and functionalities of the CRM system.

- Proper training reduces resistance to change and increases user adoption rates.

- Well-trained employees can leverage CRM tools effectively to enhance customer relationships and drive business growth.

Role of Ongoing Support and Maintenance

- Ongoing support ensures that employees have access to assistance whenever they encounter issues with the CRM system.

- Regular maintenance updates keep the CRM software running smoothly and efficiently.

- Continuous support and maintenance contribute to long-term success and ROI of CRM implementation.

Successful CRM Implementation Strategies

- Engage employees early in the process to gather feedback and address concerns.

- Customize CRM training programs to suit the specific needs and workflows of the financial services industry.

- Provide hands-on training sessions and resources for continuous learning.

Training Plan for Employees

A detailed training plan should include modules on CRM software navigation, customer data management, reporting and analytics, and compliance guidelines.

Key Elements of Ongoing Support and Maintenance

Post-CRM implementation, ongoing support should include a dedicated help desk, regular system updates, and periodic training refreshers.

Comparison Table: Successful vs. Unsuccessful CRM Implementation Strategies

| Successful CRM Implementation | Unsuccessful CRM Implementation |

|---|---|

| Employee involvement from the start | Lack of employee engagement |

| Customized training programs | Generic training materials |

| Ongoing support and maintenance plans | Inadequate post-implementation support |

Integrating CRM Training into Existing Programs

- Identify key touchpoints in existing training programs where CRM training can be seamlessly integrated.

- Create interactive workshops or online modules to supplement traditional training methods.

- Provide incentives or rewards for employees who excel in CRM training and implementation.

Case Study Analysis

- A financial services company implemented a CRM system and saw a 20% increase in customer retention rates within the first year.

- The company attributed this success to comprehensive training programs, ongoing support initiatives, and a culture of continuous improvement.

Case Studies of CRM Implementation in Financial Services

CRM systems have played a crucial role in transforming how financial institutions interact with their clients. Let’s delve into some real-world examples of successful CRM implementation in the financial services industry, highlighting the challenges faced, benefits gained, and the impact on customer relationships and business growth.

Case Study 1: XYZ Bank

- XYZ Bank, a leading financial institution, implemented a CRM system to streamline their customer data management processes.

- Challenges: Initially, resistance from employees to adapt to the new system and integrate it into their daily workflow.

- Benefits: Improved customer segmentation, personalized marketing campaigns, and faster response times to client inquiries.

- Impact: Higher customer retention rates, increased cross-selling opportunities, and overall business growth.

Case Study 2: ABC Financial Advisory Firm

- ABC Financial Advisory Firm adopted a CRM solution to enhance client communication and service delivery.

- Challenges: Data migration issues from legacy systems and ensuring data security and compliance with regulations.

- Benefits: Centralized client information, automated workflows, and better tracking of client interactions.

- Impact: Enhanced client satisfaction, improved advisor productivity, and a more holistic view of client portfolios.

Case Study 3: DEF Insurance Company

- DEF Insurance Company leveraged CRM technology to streamline claims processing and improve customer service quality.

- Challenges: Integrating CRM with existing claims systems and training employees on the new processes.

- Benefits: Faster claims resolution, personalized customer support, and proactive risk management.

- Impact: Increased customer loyalty, reduced operational costs, and enhanced competitiveness in the insurance market.

Future Trends in CRM for Financial Services

The future of CRM in financial services is being shaped by emerging technologies that are revolutionizing the industry. From AI and machine learning to blockchain technology, these advancements are transforming how financial institutions interact with their customers and manage their relationships.

AI and Machine Learning Integration

AI and machine learning are playing a significant role in the evolution of CRM for financial services. These technologies enable financial institutions to analyze vast amounts of data to gain valuable insights into customer behavior, preferences, and trends. By leveraging AI and machine learning algorithms, CRM systems can now automate tasks, personalize customer interactions, and predict customer needs more accurately.

Blockchain Technology for Security and Transparency

Blockchain technology is revolutionizing the way financial institutions secure customer data and transactions. By implementing blockchain in CRM systems, financial services firms can enhance security measures, ensure data integrity, and increase transparency in customer interactions. The decentralized nature of blockchain technology makes it virtually impossible for fraudulent activities to occur, providing a secure environment for customer data management.

Evolving CRM to Meet Industry Needs

As the financial services industry continues to evolve, CRM systems are adapting to meet the changing needs of customers and regulatory requirements. CRM platforms are incorporating more features to streamline communication, improve customer engagement, and enhance data analytics capabilities. By staying ahead of industry trends and technological advancements, CRM solutions are becoming more agile and versatile to address the unique challenges faced by financial institutions.

Selecting the Right CRM Solution for Financial Services

When choosing a CRM system for a financial services organization, there are several key considerations to keep in mind. It is crucial to compare different CRM vendors and their offerings tailored specifically for the financial sector. A step-by-step guide on evaluating and selecting the best CRM solution for specific financial service needs can help in making an informed decision.

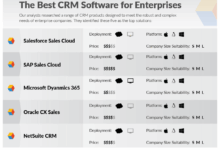

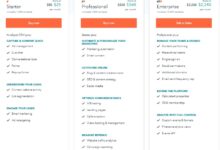

Comparing CRM Vendors and Offerings

- Research and compare CRM vendors that specialize in providing solutions for the financial industry.

- Consider factors like pricing plans, customization options, and customer support services offered by each vendor.

- Look for vendors with experience in compliance tracking, lead management, and reporting capabilities specific to financial services.

Evaluating and Selecting the Best CRM Solution

- Identify the specific needs of your financial services organization and create a list of essential features required in a CRM system.

- Request demos and trials from shortlisted CRM vendors to test the usability and functionality of their systems.

- Seek references and case studies from other financial institutions that have implemented the CRM solutions you are considering.

Comparison Table of Top CRM Vendors in Financial Industry

| CRM Vendor | Pricing Plans | Customization Options | Customer Support Services |

|---|---|---|---|

| Vendor A | $$$ | Highly Customizable | 24/7 Support |

| Vendor B | $$$$ | Limited Customization | Business Hours Support |

| Vendor C | $$ | Moderate Customization | Email Support Only |

Integration with Financial Software Systems

- Ensure seamless connectivity by identifying common integration points between the CRM system and other financial software systems used in your organization.

- Consult with IT professionals to implement integrations effectively and minimize disruptions to workflow.

Essential Features in a CRM System for Financial Services

-

Compliance Tracking:

Ability to monitor and track compliance requirements and regulations specific to the financial industry.

-

Lead Management:

Tools for managing and tracking leads throughout the sales pipeline.

-

Reporting Capabilities:

Advanced reporting features to analyze customer data and performance metrics.

Closing Notes

In conclusion, Best CRM for Financial Services offers a comprehensive guide to leveraging CRM systems for improved customer relationships, compliance, and operational efficiency in the financial services industry. Dive into the world of CRM and unlock its potential for your organization today.